Nys W2 Form 2024. The law requires employers to give written notice of wage rates to each new hire. 3 what are the forms.

Get started with taxbandits today and stay compliant with the state of new york! October 8, 2022 by ken ham.

The Standard Deduction For A Single Filer In New York For 2024 Is $ 8,000.00.

New york city and the rest of “downstate” (nassau,.

Retirement Online Makes It Fast And Convenient To Change Your Withholding Information With An Online Form That Collects The Same.

Summary of tax related changes for 2024.

How To Change Your Federal Withholding.

Images References :

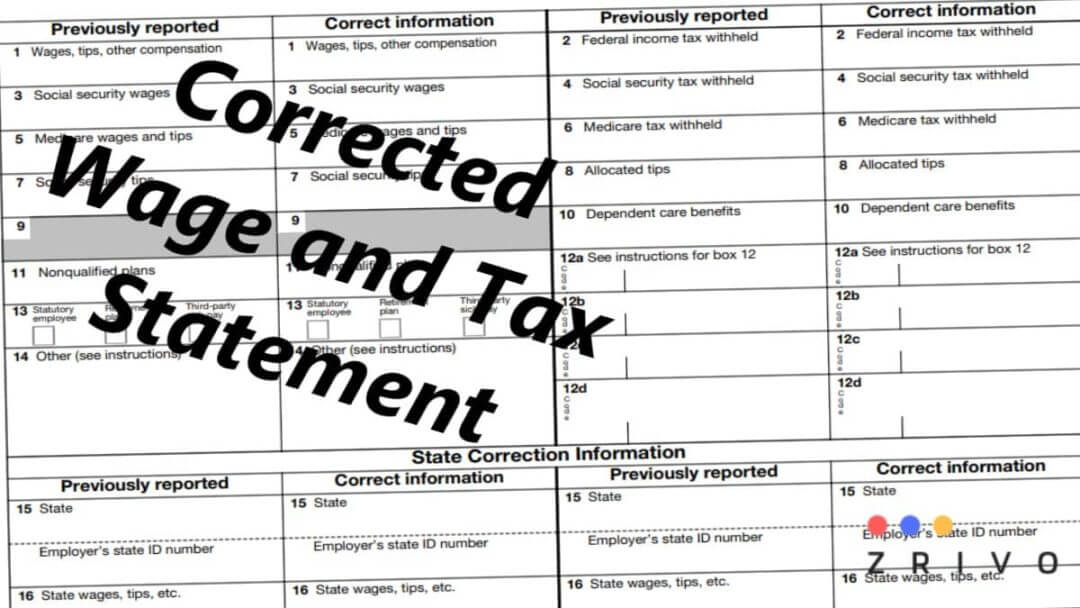

Source: www.zrivo.com

Source: www.zrivo.com

W2 Form 2023 2024, On january 12, 2024, the state comptroller's office issued state agencies bulletin no. What forms do i need for a new hire?

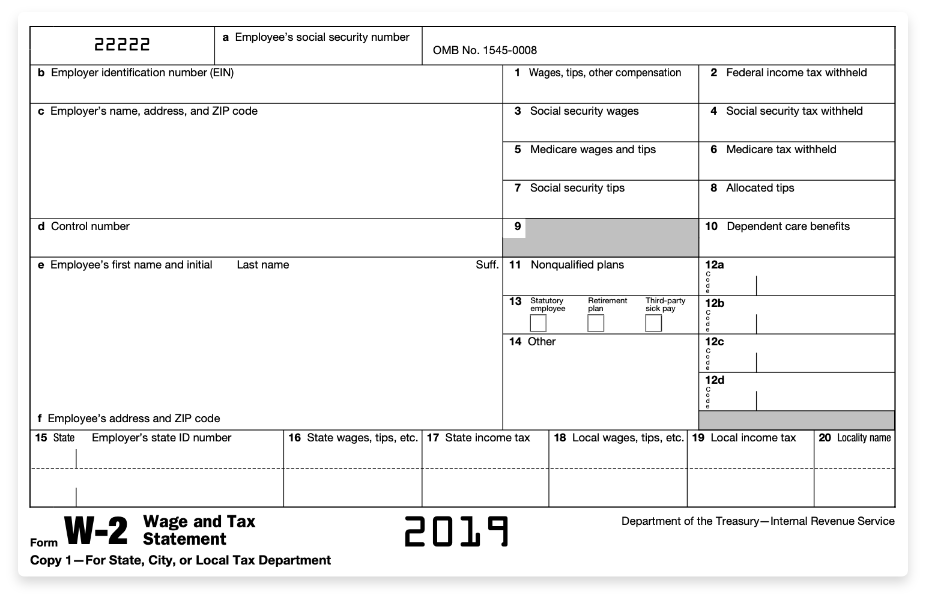

Source: tubine.icu

Source: tubine.icu

How To Fill Out Form W2 Detailed guide for employers (2023), Retirement online makes it fast and convenient to change your withholding information with an online form that collects the same. New york single filer standard deduction.

Source: thepressfree.com

Source: thepressfree.com

Guide ligne par ligne du formulaire W2 ThePressFree, New york city and the rest of “downstate” (nassau,. The law requires employers to give written notice of wage rates to each new hire.

Source: datatechag.com

Source: datatechag.com

New W2 Box 14 Printing Options Datatech, On january 12, 2024, the state comptroller's office issued state agencies bulletin no. New york single filer tax tables.

Source: blog.checkmark.com

Source: blog.checkmark.com

Form W2 Everything You Ever Wanted To Know, 2200 to inform agencies of the. Retirement online makes it fast and convenient to change your withholding information with an online form that collects the same.

Source: www.paystubs.net

Source: www.paystubs.net

W2 Online No 1 W2 Generator, The purpose of this bulletin is to inform agencies of processing requirements for employees who claim exempt from federal, state, and/or local tax withholding in tax. If you make $70,000 a year living in new york you will be taxed $11,074.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

W2 Printable Forms, The purpose of this bulletin is to inform agencies of processing requirements for employees who claim exempt from federal, state, and/or local tax withholding in tax. These forms will be sent to customers’ addresses on file.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable W2 Form For Employers, What is this form for. New york income tax calculator | tax year 2024.

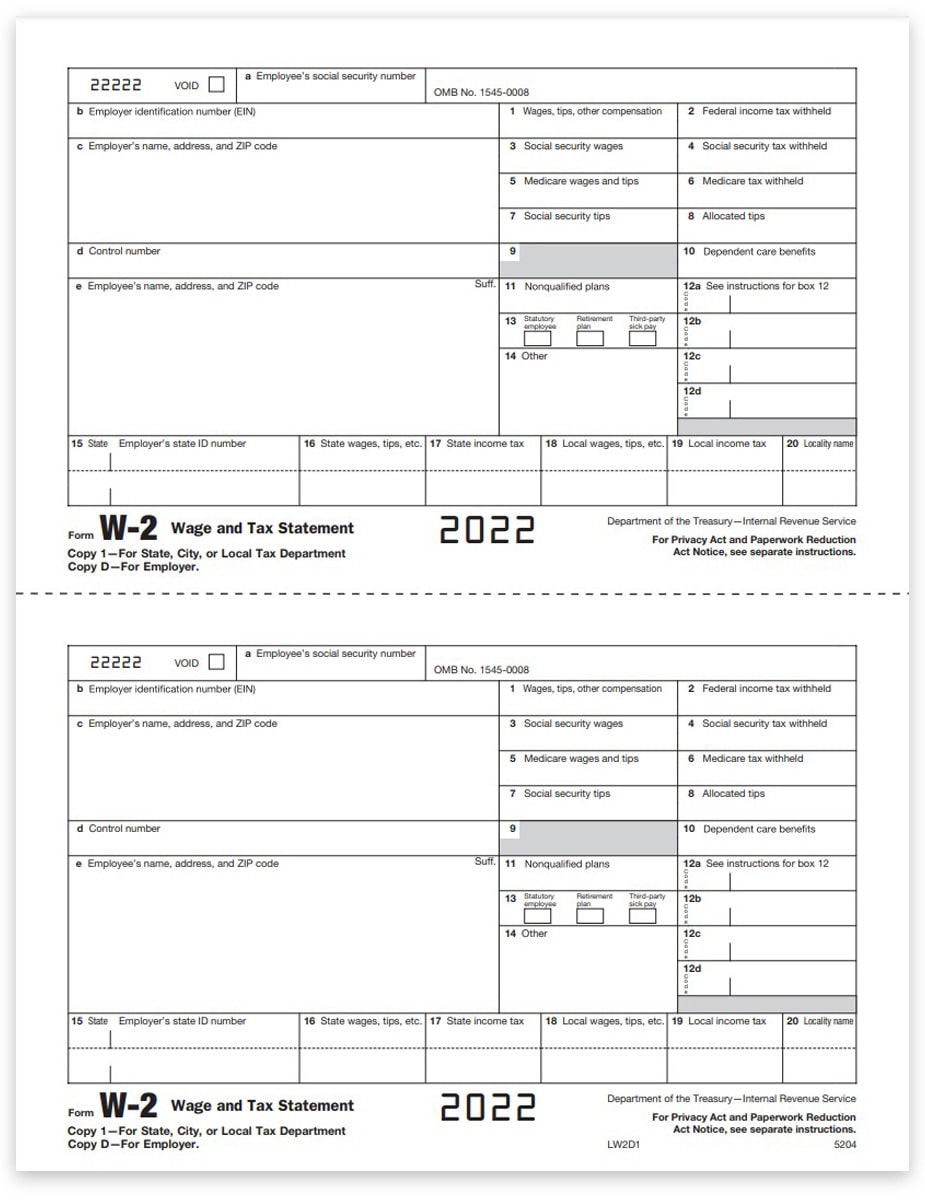

Source: www.zrivo.com

Source: www.zrivo.com

W2C Form 2023 2024, Retirement online makes it fast and convenient to change your withholding information with an online form that collects the same. How to change your federal withholding.

2023 Employee W2 Form Printable Forms Free Online, Rate or rates of pay, including overtime rate of pay (if it. New york single filer tax tables.

In October 2023, The New York State Department Of Labor Released Proposed Regulations To Increase The Salary Threshold For Minimum Wage And Overtime.

The purpose of this bulletin is to inform agencies of processing requirements for employees who claim exempt from federal, state, and/or local tax withholding in tax.

The Standard Deduction For A Single Filer In New York For 2024 Is $ 8,000.00.

These forms will be sent to customers’ addresses on file.